Differences Between Non-Profit, L3c and PBLLC

A Non-Profit, the most common of which is a 501(c)(3) may take donations on a tax deductable basis and its purpose is not to make profit, but to accomplish a mission for the purpose of charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals. 501(c)(3) organizations are absolutely prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office. Other Non-Profits such as a 501(c)(6) has to be financially supported by membership, however is allowed to seek the accomplishment of one or more political or legislative purposes

A Low-Profit Limited Liability Company (L3C) is an incorporated business structure that benefits society and also generates profits for its owners. It combines the financial benefits of a traditional for-profit entity with the social benefits of a nonprofit.

The L3C has to satisfy three requirements:

1. It significantly furthers the accomplishment of one or more charitable or educational purposes within the meaning of Sec, 170(c)(2)(b) of the Internal Revenue Code and would not have been formed but for the company's relationship to the accomplishment of those charitable or educational purposes.

2. I does not have a significant purpose the production of income or the appreciation of property.

3. It does not have as a purpose the accomplishment of one or more political or legislative purposes.

Those three requirements are imposed for a reason, They match the conditions imposed by the Internal Rvenue Service on the type of business in which a charitable foundation can make a program-related investment (PRI).

L3C's and PBLLC's cannot be incorporated in Norther Carolina, therefore, they (can) operate as a registered foreign company (in North Carolina) of another State which recognies those coporate structures.

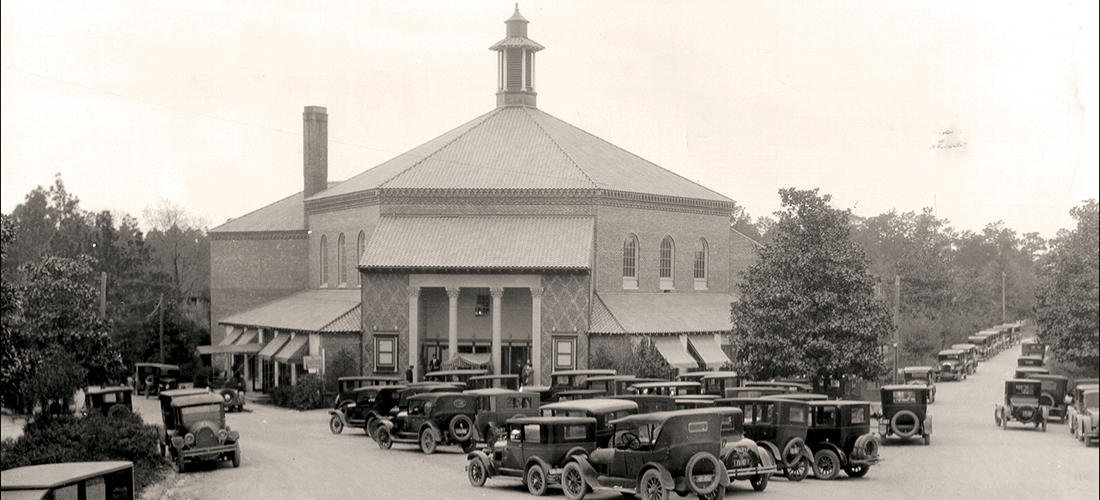

A Public Benefit LLC. In Celebration of Pinehurst (Celebrate Pinehurst, LLC) is a Delaware Public Benefit LLC or PBLLC, reflecting its positive effect--or reduction of negative effects--of an educational and charitable nature for the community of Pinehurst, NC. It aligns the company to its public-focused mission.

Public Benefit LLC's like any LLC or for profit corporation, may endorse candidates for public office, if it so chooses, and it can expressly advocate for the election or defeat of a specific candidate.

A PBLLC lets investors, advisors, employees, and customers know about the socially-conscious mission enmeshed into the framework of the business. It also creates ease for investors to assess the business because of new statutory requirements, including a mandatory statement every other year that reports on the company's promotion of its stated public benefit. The statement must include:

· the objectives the company has established to promote the public benefit;

· the standards for measuring its progress;

· factual information based on those standards; and

· an assessment of the company's success in meeting its objectives.

Elevating Pinehurst History, Engagement & Improvement